Senior Family Engagement Newsletter

| October Newsletter |

October Senior Family Engagement Newsletter

|

Financial aid helps students pay for the cost of attending college, such as tuition, fees, books, housing, transportation, and other expenses. The goal is to make college more affordable and accessible. Financial aid can come from different sources and in different forms and most students use multiple types of funds to afford college.

|

||||

|

Types of Financial Aid

Grants – Free money that doesn’t have to be repaid (example: Pell Grant, Cal Grant).

Scholarships – Free money awarded for achievements based on academics, athletics, community service, etc. Work-Study – Paid, part-time work (usually on campus) while enrolled. Loans – Borrowed money that students (or parents) must repay, usually with interest. Want to learn more about the different types of Financial Aid? Click Here |

||||

|

Sources of Financial Aid

Federal: The Free Application for Federal Student Aid (FAFSA) is for students

State: The California Dream Act Application (CADAA) allows certain students, including undocumented students and mixed-status families, to qualify for in-state tuition at California public colleges and universities by providing an exemption from non-resident supplemental tuition fees. The Cal Grant is a California-specific financial aid allocation that does not need to be paid back. Cal Grant applicants must apply using the FAFSA or CA Dream Act Application by the deadline and meet all eligibility, financial, and minimum GPA requirements of either program. You don’t need to apply for the grant. If you meet the requirements to qualify and you submit by April 2, 2026, you will receive the award. The Middle Class Scholarship provides undergraduate students with a scholarship to attend a University of California (UC) or California State University (CSU). The family income and asset limits can be found here: https://www.csac.ca.gov/middle-class-scholarship. They are updated annually. The California Chafee Grant is free money for current or former foster youth to help pay for college, career, or technical training that you don’t have to pay back. You may also be able to use your grant to pay for child care, transportation, and rent while you’re in school. The CalKIDS program provides financial assistance for college or career training to eligible students in California.

|

||||

|

Key Point

|

||||

|

Ways Parents Can Help with Financial Aid

Paying for college can feel complicated, but students don’t have to go through the process alone. Parents play an important role in helping their student stay organized, meet deadlines, and make informed choices about college costs.

One of the first steps is gathering financial documents. Applications like the FAFSA and CADAA require tax returns, W-2s, bank statements, and other records of income. Most students under 24 will need to include their parent or guardian’s information. However, students who are experiencing homelessness and are not living with or supported by a parent may be considered independent, which means they can complete the FAFSA or CADAA without parent information Parents can also make the process easier by completing the FAFSA or CADAA alongside their student. For the 2025–26 school year, both applications open on October 1, 2025, and the priority deadline for Cal Grants is April 2, 2026. Applying early ensures students are considered for the maximum amount of aid. Keeping track of deadlines is essential. Missing federal, state, or campus deadlines often means losing out on free money for college. Parents can help by organizing important dates and reminders so nothing is overlooked. Beyond federal and state aid, scholarships are another valuable way to reduce college costs. Parents can encourage their student to search and apply for local and national scholarships. Even smaller awards can add up quickly and make a big difference. When award letters arrive from colleges, reviewing them together helps families compare offers and understand the mix of grants, loans, and out-of-pocket costs. Attending spring financial aid workshops can also provide extra guidance in making the best decision. Having open conversations about the family budget is equally important. Being realistic about what the family can contribute allows students to make informed choices when comparing colleges and aid offers. Most importantly, students benefit from encouragement and support. The financial aid process can be overwhelming, but parents who stay positive and organized help reduce stress. Families looking for extra guidance can join free College Access Hub Zoom sessions or attend a Cash for College workshop, offered both online and in person. By staying engaged, informed, and supportive, parents can make a challenging process much smoother and help their student focus on what really matters: preparing for a successful college experience. |

||||

|

Financial Aid Checklist for Students & Parents

Click here to download checklist!

|

||||

|

Tip for Parents & Students

Please use the resources on our website and at these official websites to learn more: Your school college counselor can help. You can attend our College Access Hubs and register for free today! Both online webinars and in-person workshops near you are available.

|

||||

|

College Myths (and Realities)

|

||||

|

|

||||

|

College Access Support Hubs for Seniors

Visit our website at a-g.lausd.org to explore additional resources, in the LAUSD Senior College Journal available online, in Schoology, and in print through your counselor. This journal is a step-by-step guide to keep seniors on track during the application process.

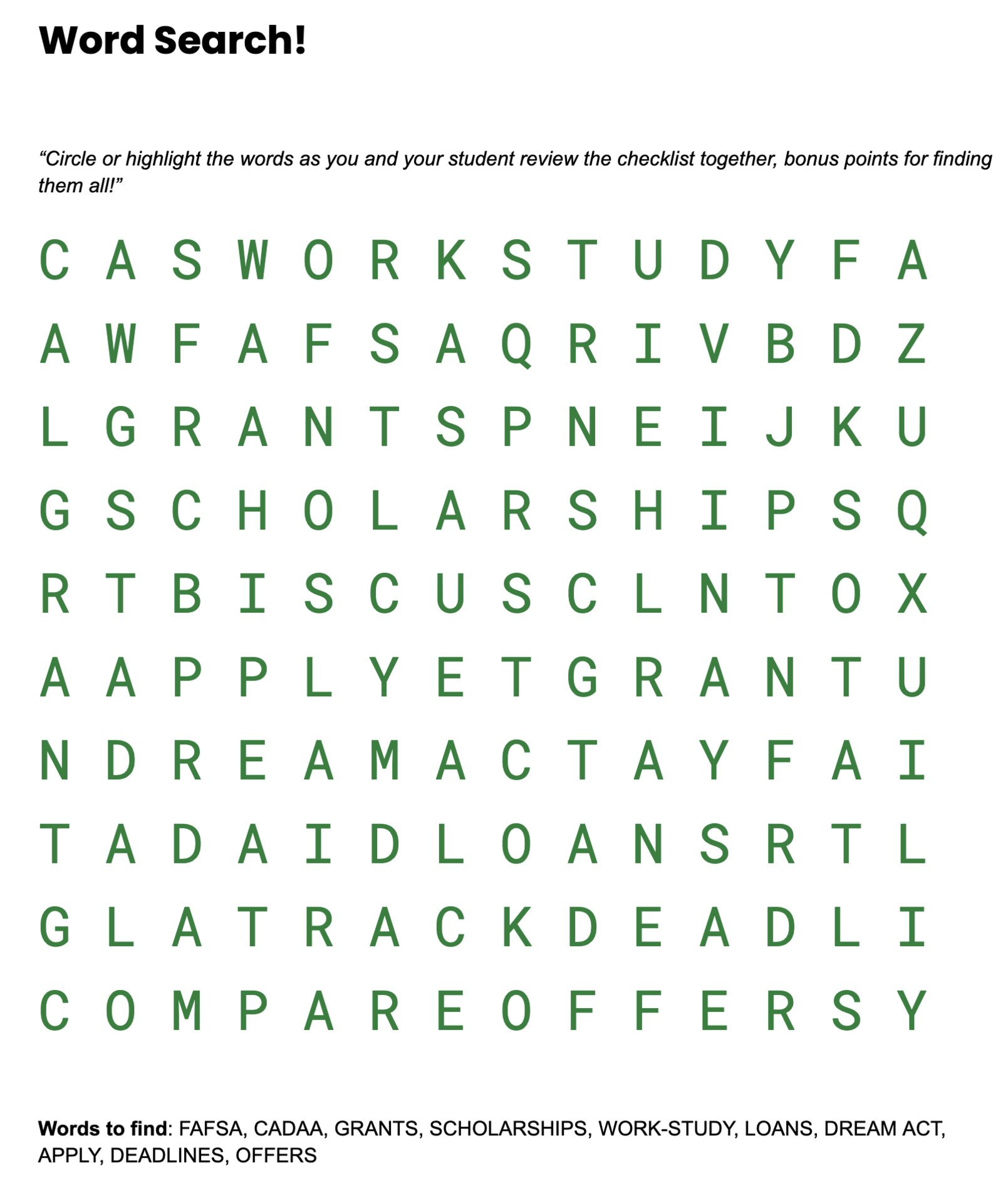

Time for a Game!

Click image below to download the Word Search

|